Moneybox – 2025

Financial Planning

Context

Many Moneybox users have clear financial ambitions - buying a home, building long-term wealth, or growing savings - but aren’t sure which products to use or how to make meaningful progress. As a result, users often keep money in suboptimal places (e.g., large cash balances that could be invested), or hold only one or two products despite having broader goals.

To support users with clearer direction and help them get more out of Moneybox, we set out to design a confidence-building experience that captures a user’s ambitions and turns them into simple, personalised next steps.

This work ran for five months across design, research, and build, with close collaboration between Product, Engineering, Data Science/Decisioning, Marketing, Compliance, and Insights.

Problem

Users frequently struggled to choose the right Moneybox products for their goals. This hesitation was visible in behaviour - especially the long time spent on the “Select an account” screen during registration and cross-sell flows. It was a clear sign that users lacked confidence in understanding which product aligned with their needs, timelines, and risk levels.

This uncertainty led to low product adoption, money sitting in less effective accounts, and weaker retention - particularly among higher-value customers who often moved money between providers. We believed that if users could articulate their ambitions and receive clear, personalised next steps, they would make more confident decisions and engage more deeply with Moneybox’s product ecosystem.

Outcome

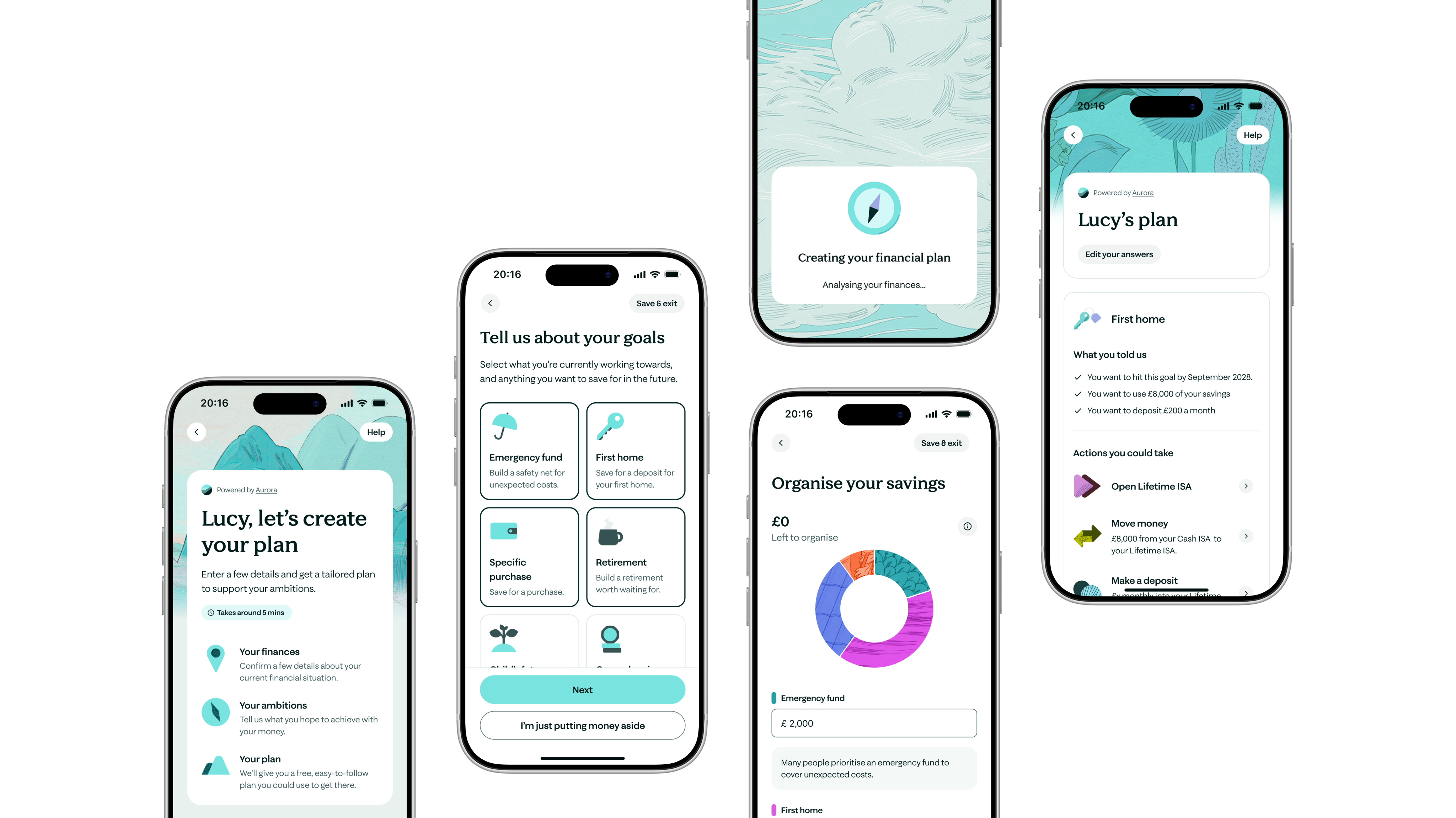

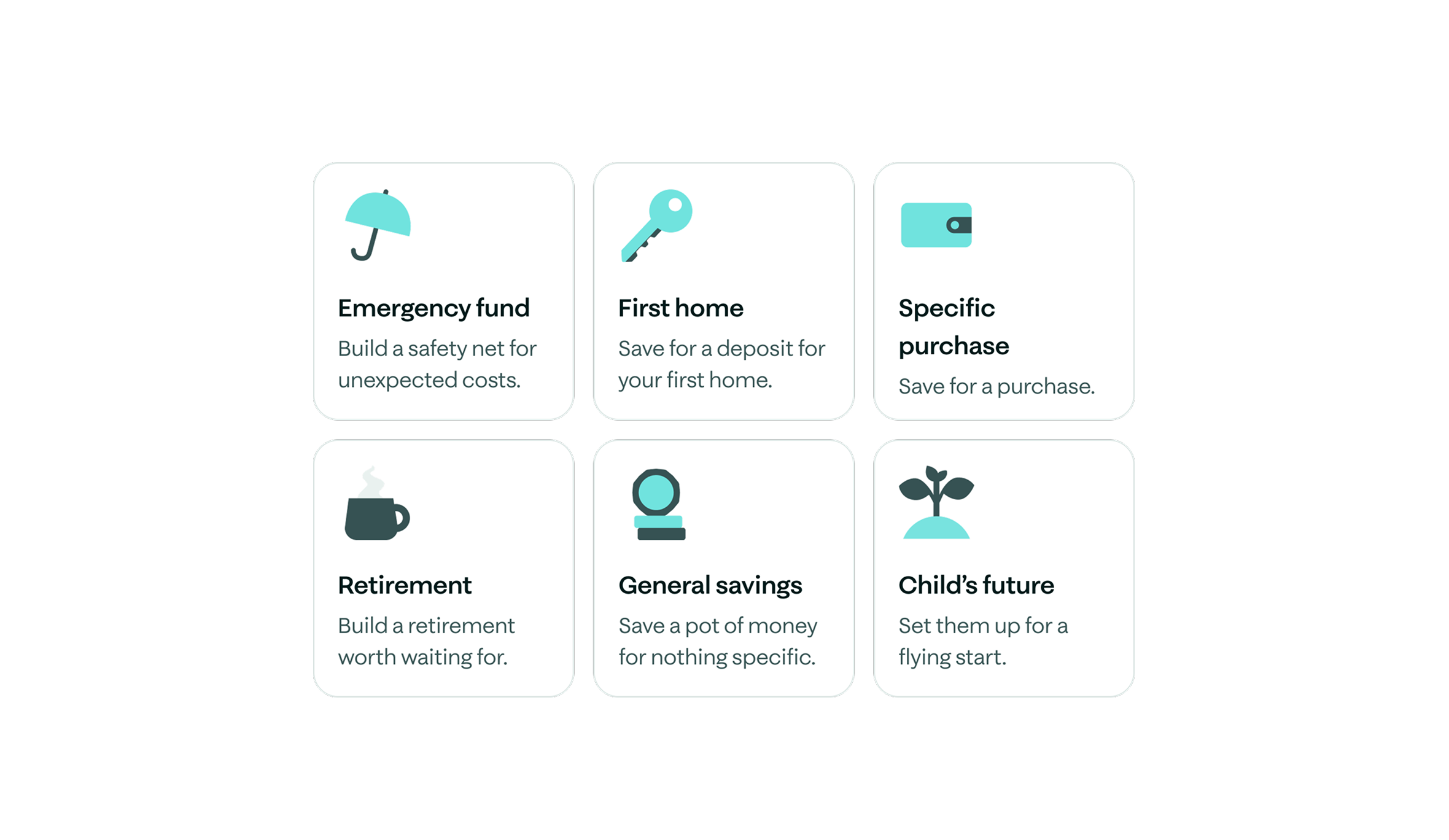

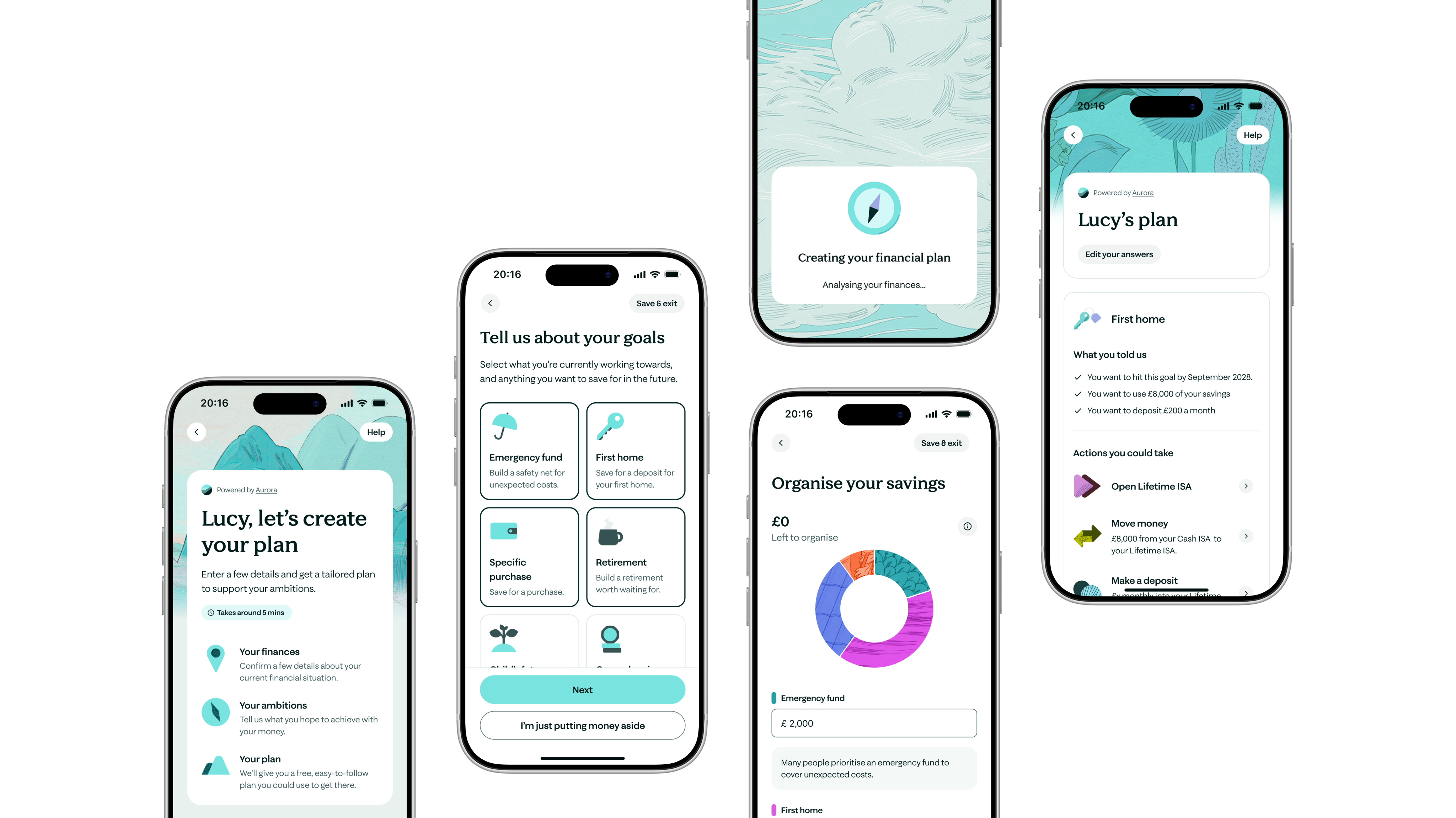

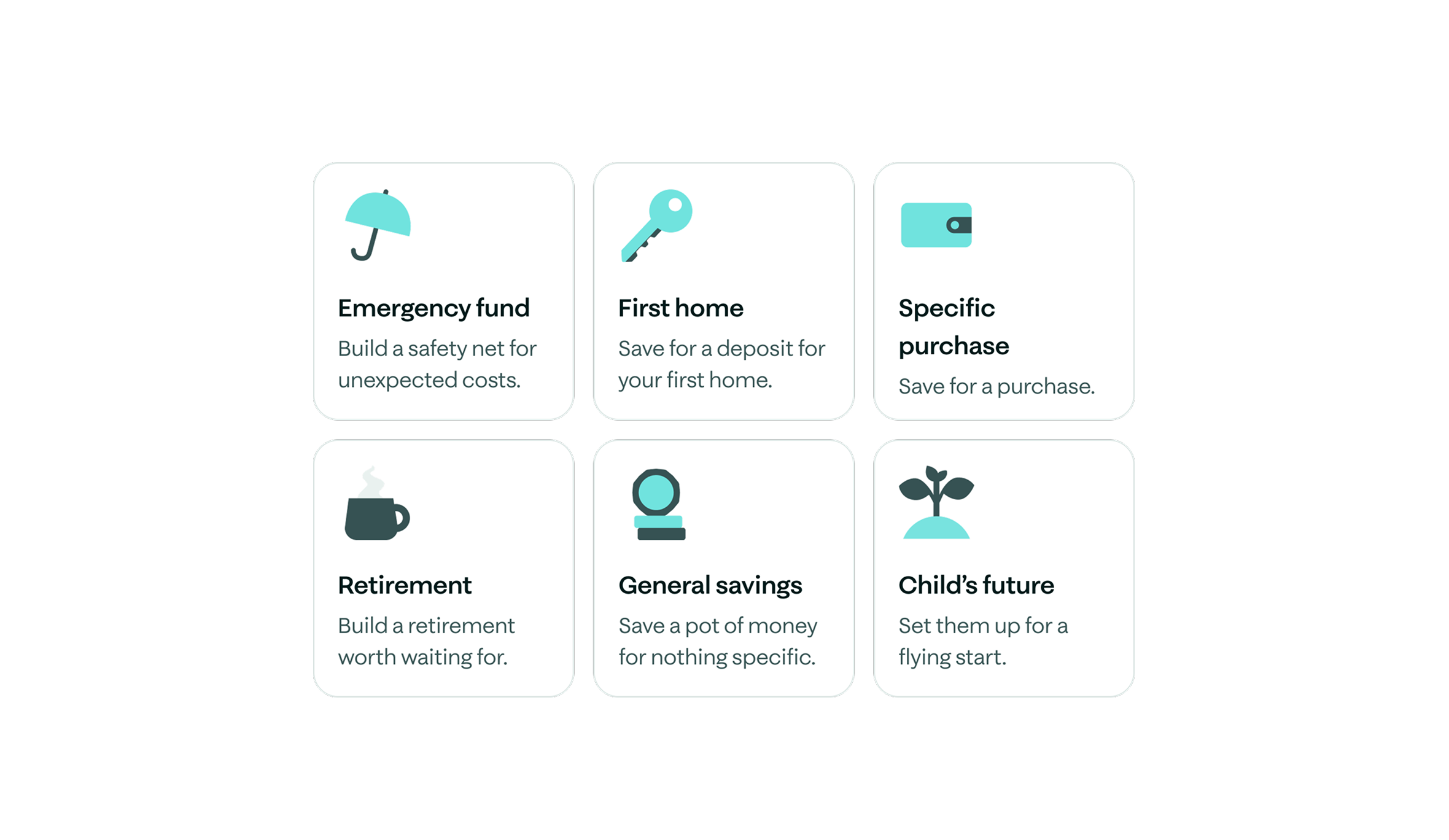

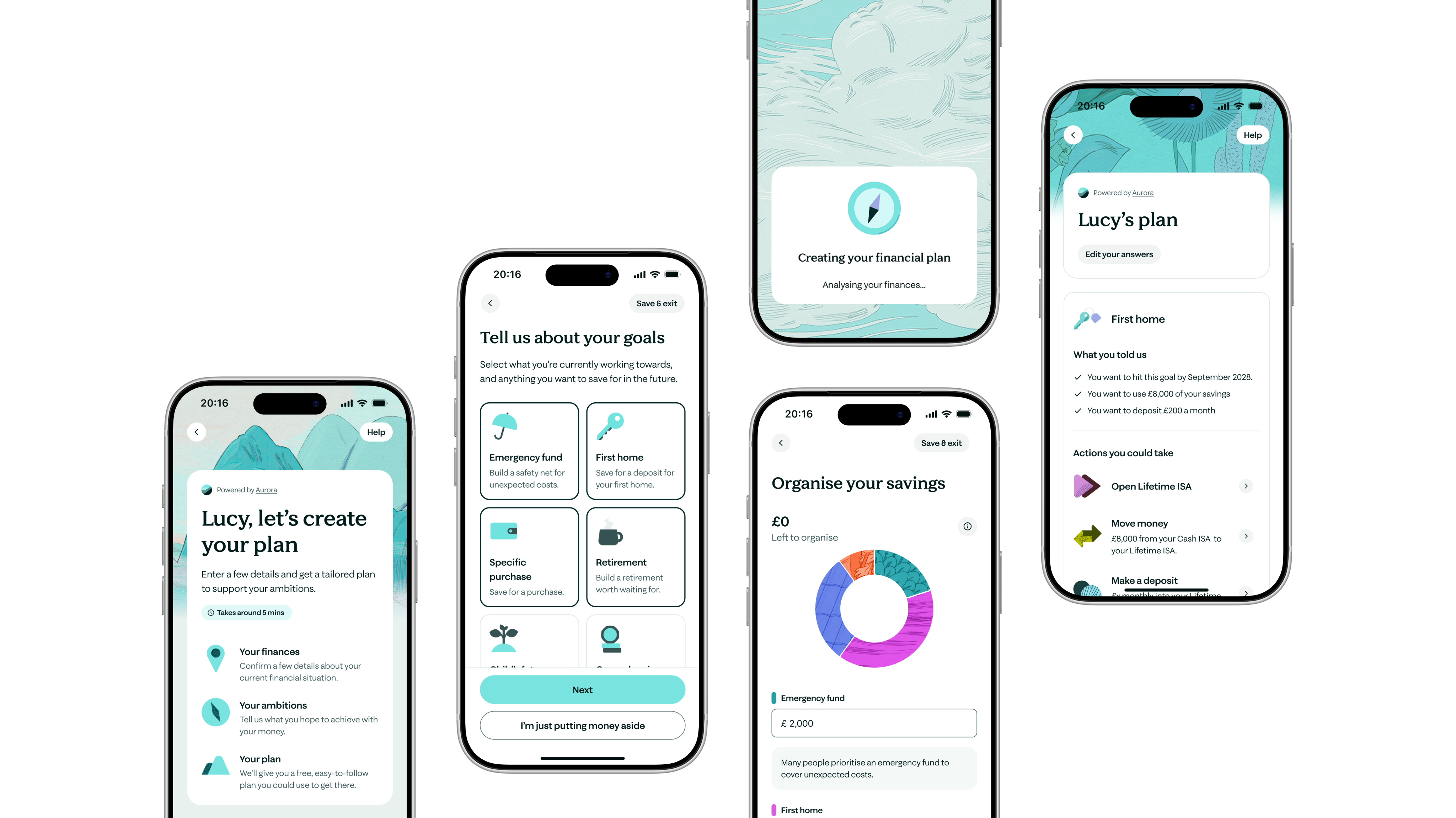

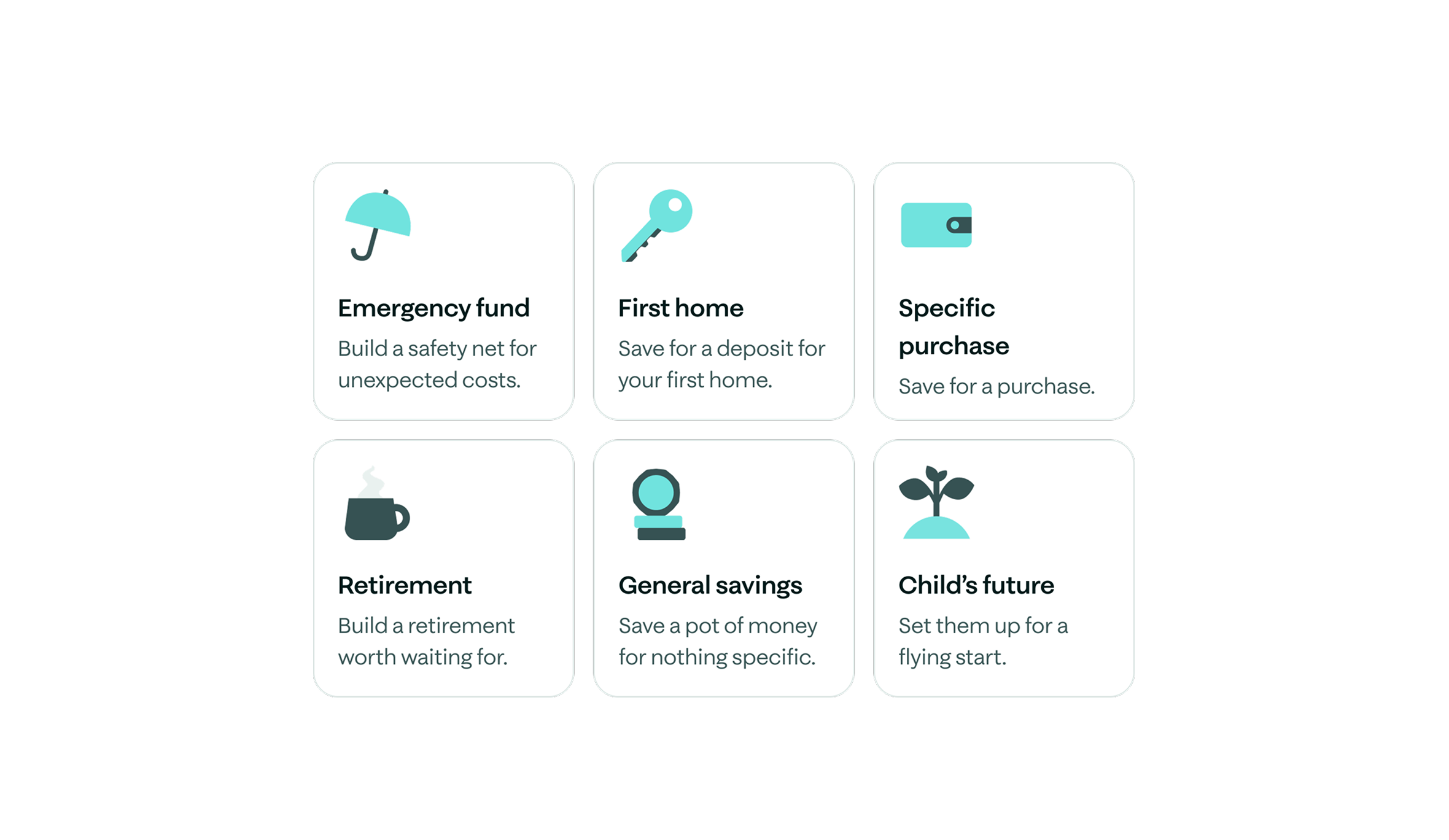

A guided flow for capturing ambitions

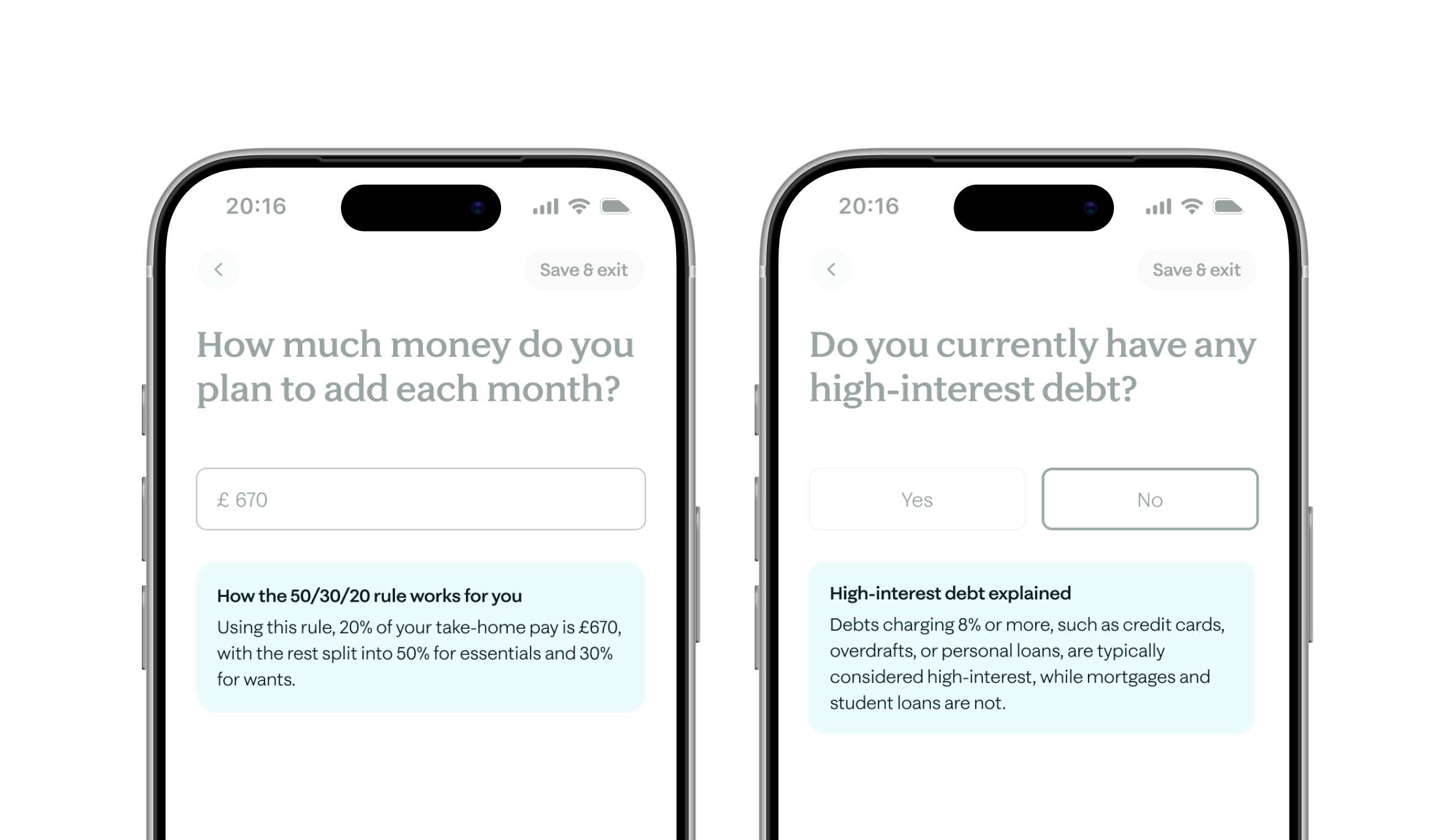

We designed a structured journey that helps users articulate both their near-term needs and long-term goals. This forms the basis of their personalised plan while staying fully within FCA guidance boundaries.

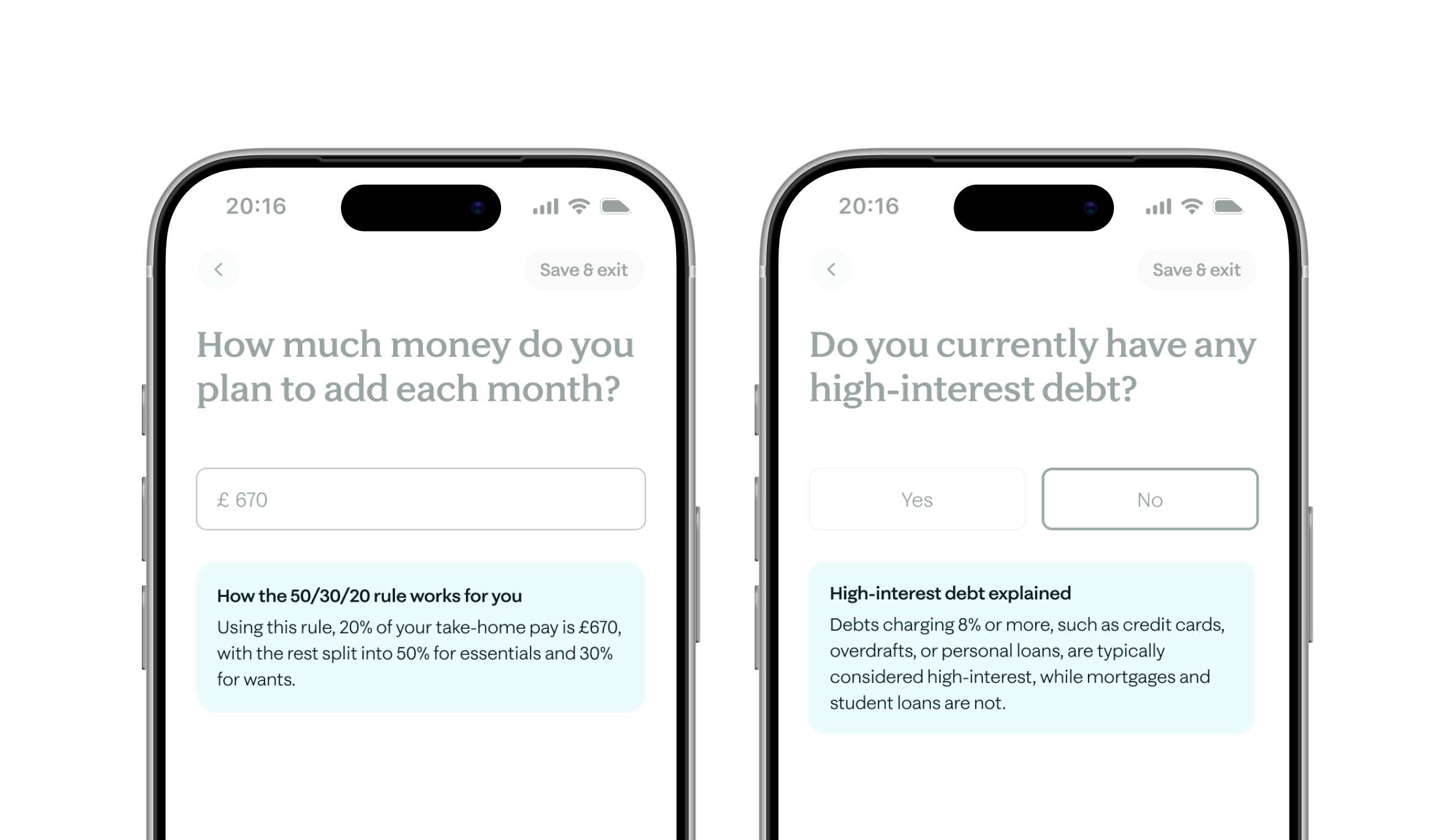

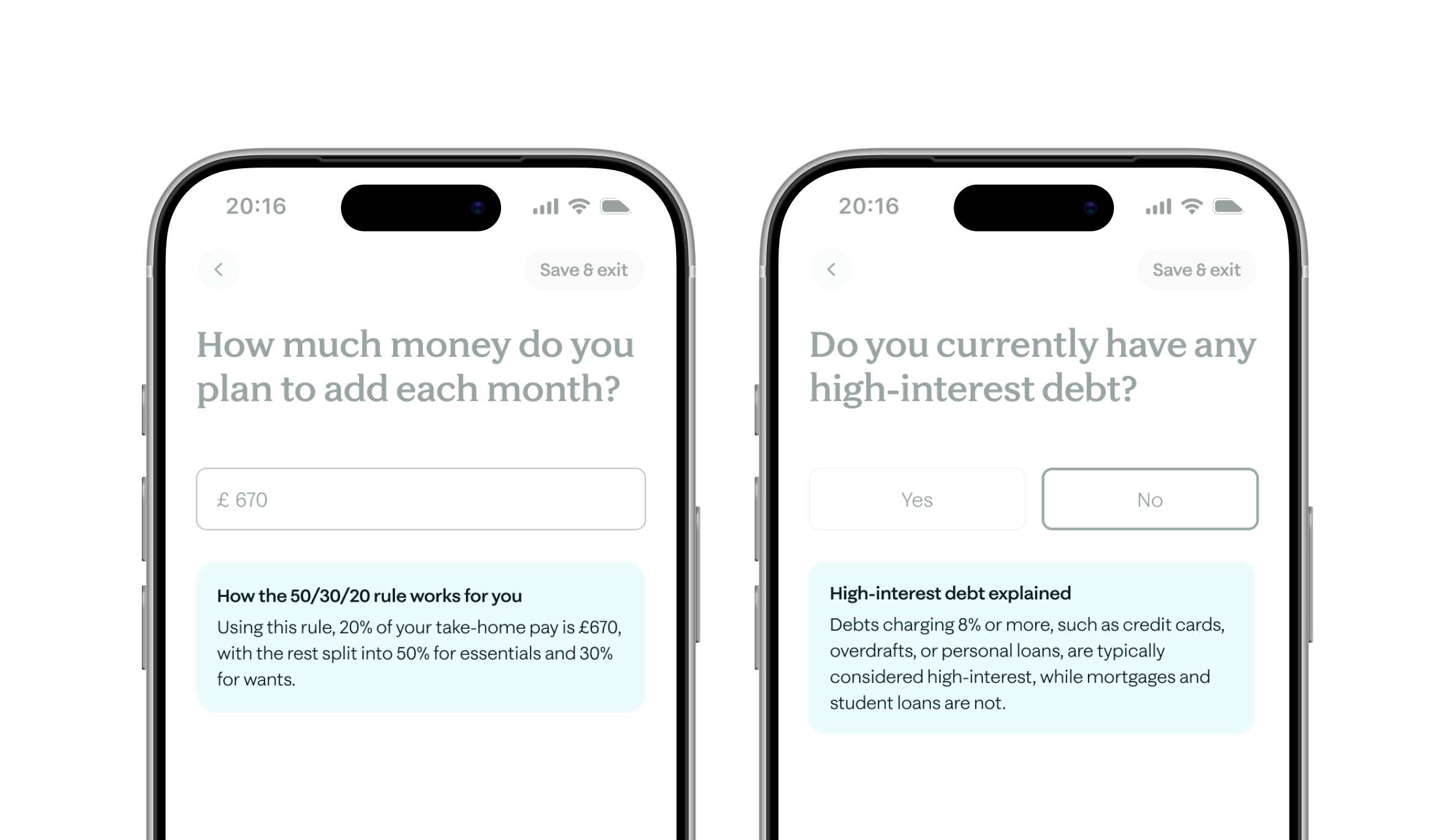

Personalised guidance at every step

Throughout the flow, users see small, tailored nudges that offer guidance based on their situation. These moments help them move through the journey with confidence and make each decision feel more personal.

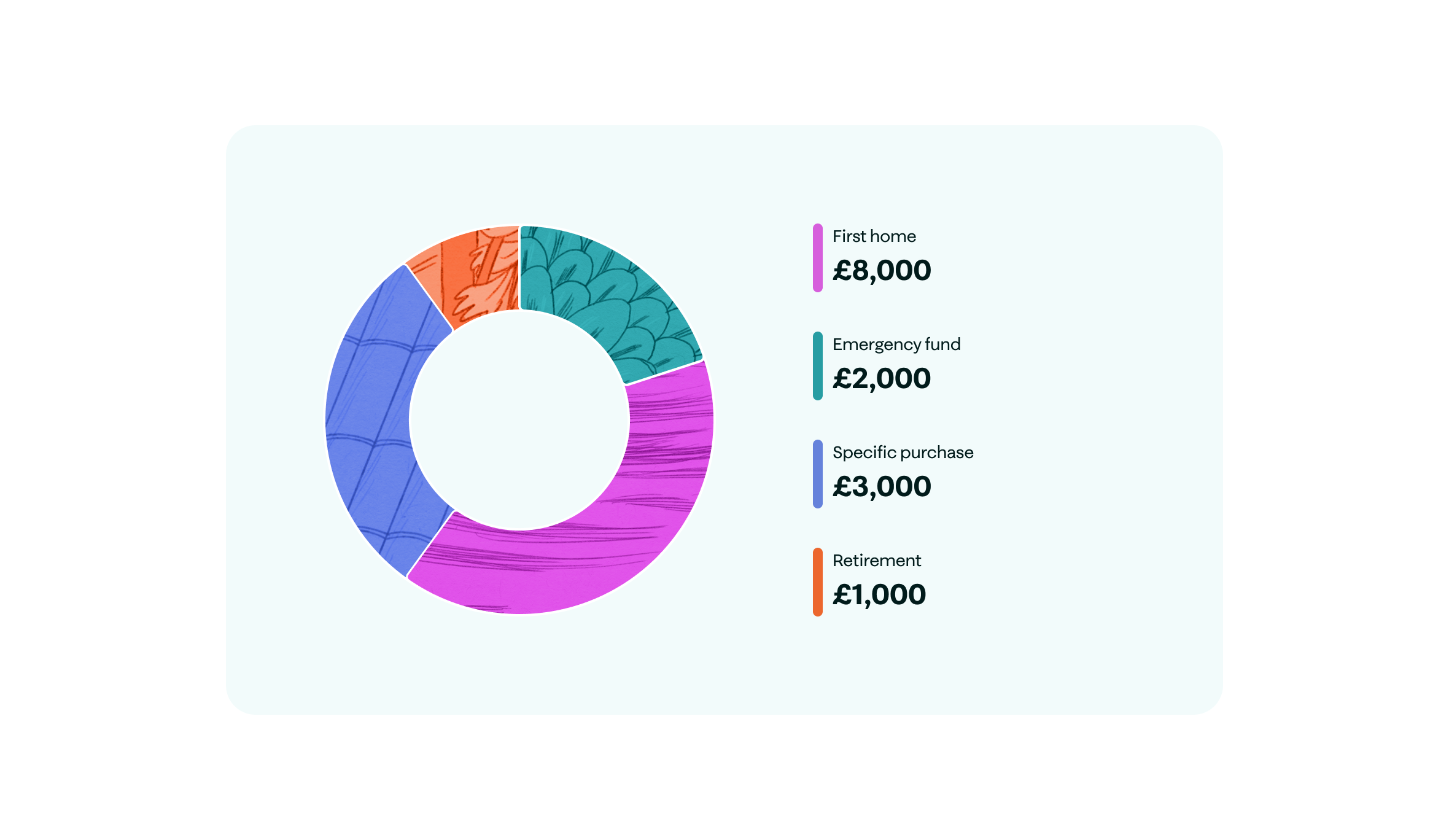

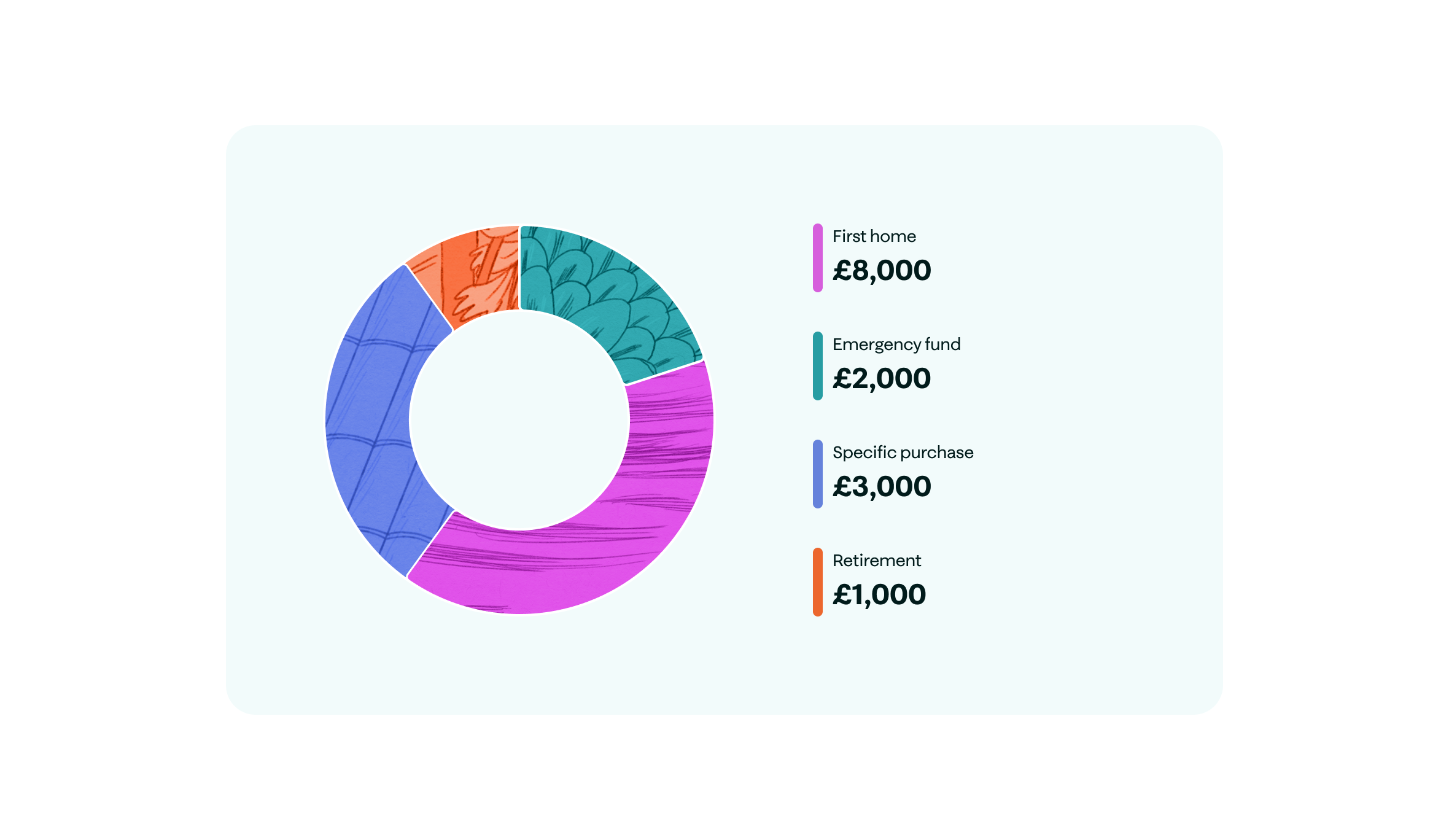

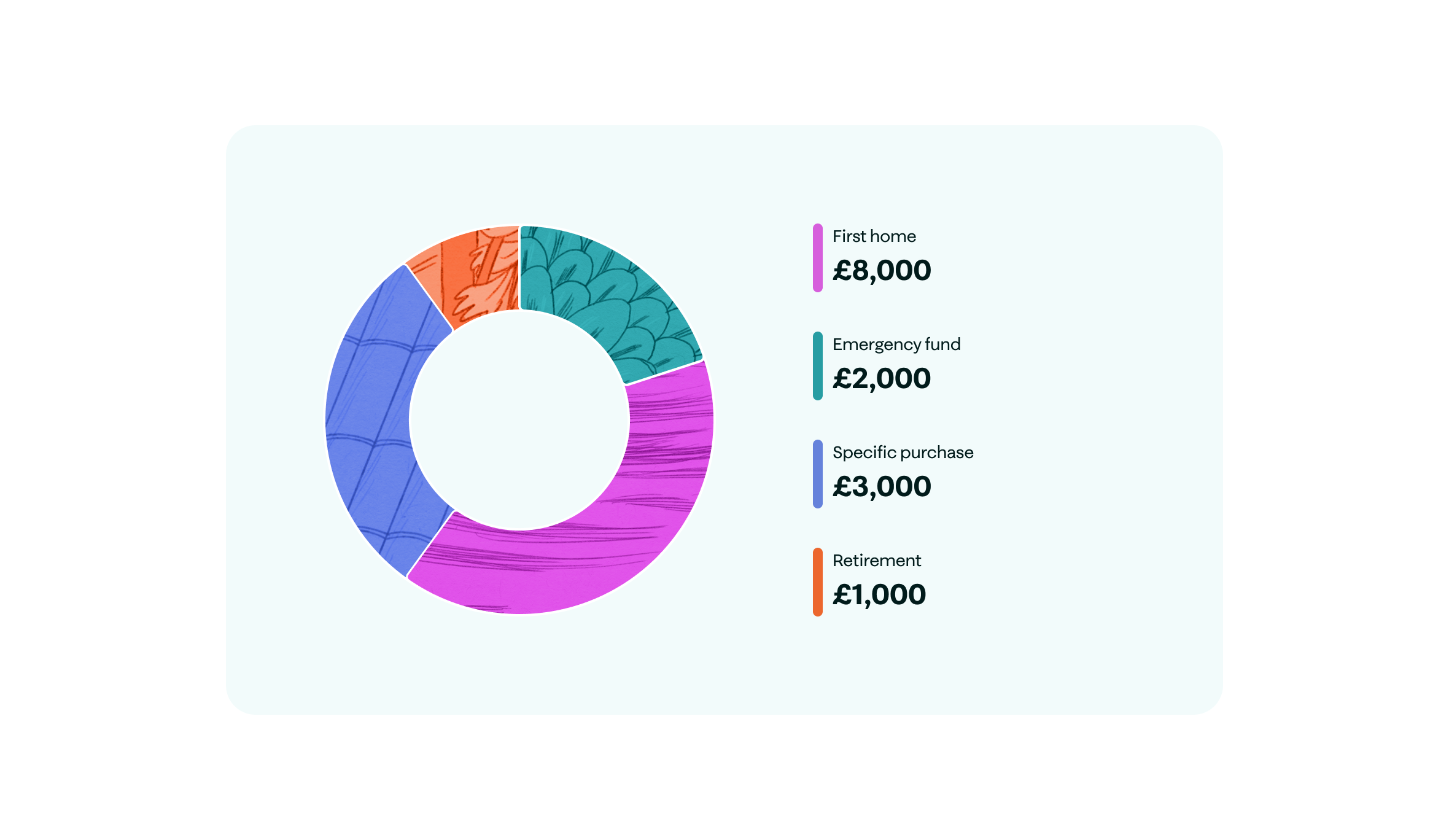

A simple way to organise money across goals

We introduced an allocation step that helps users divide their savings across the goals that matter most to them, giving them a clearer sense of how they can optimise their money.

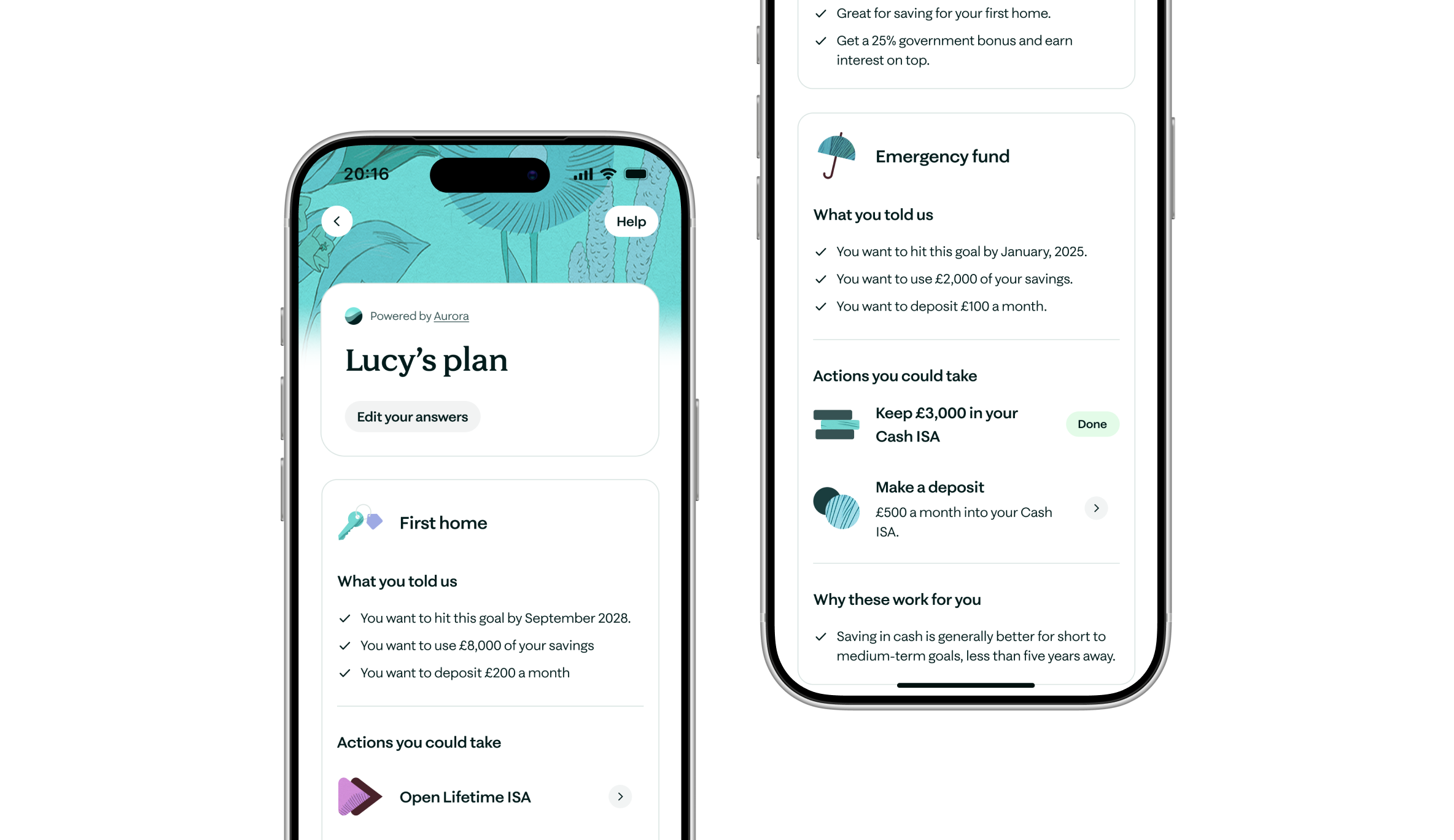

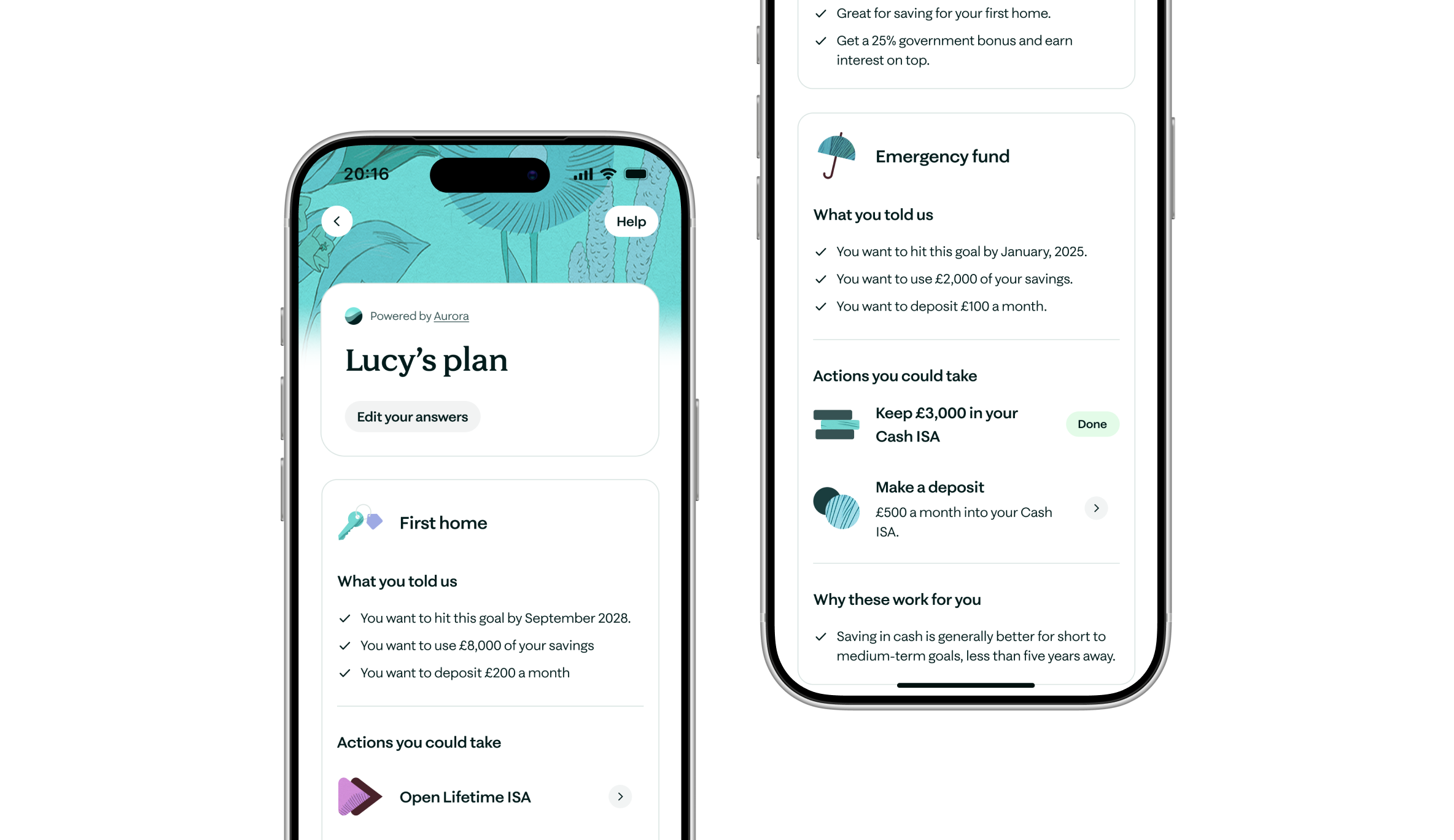

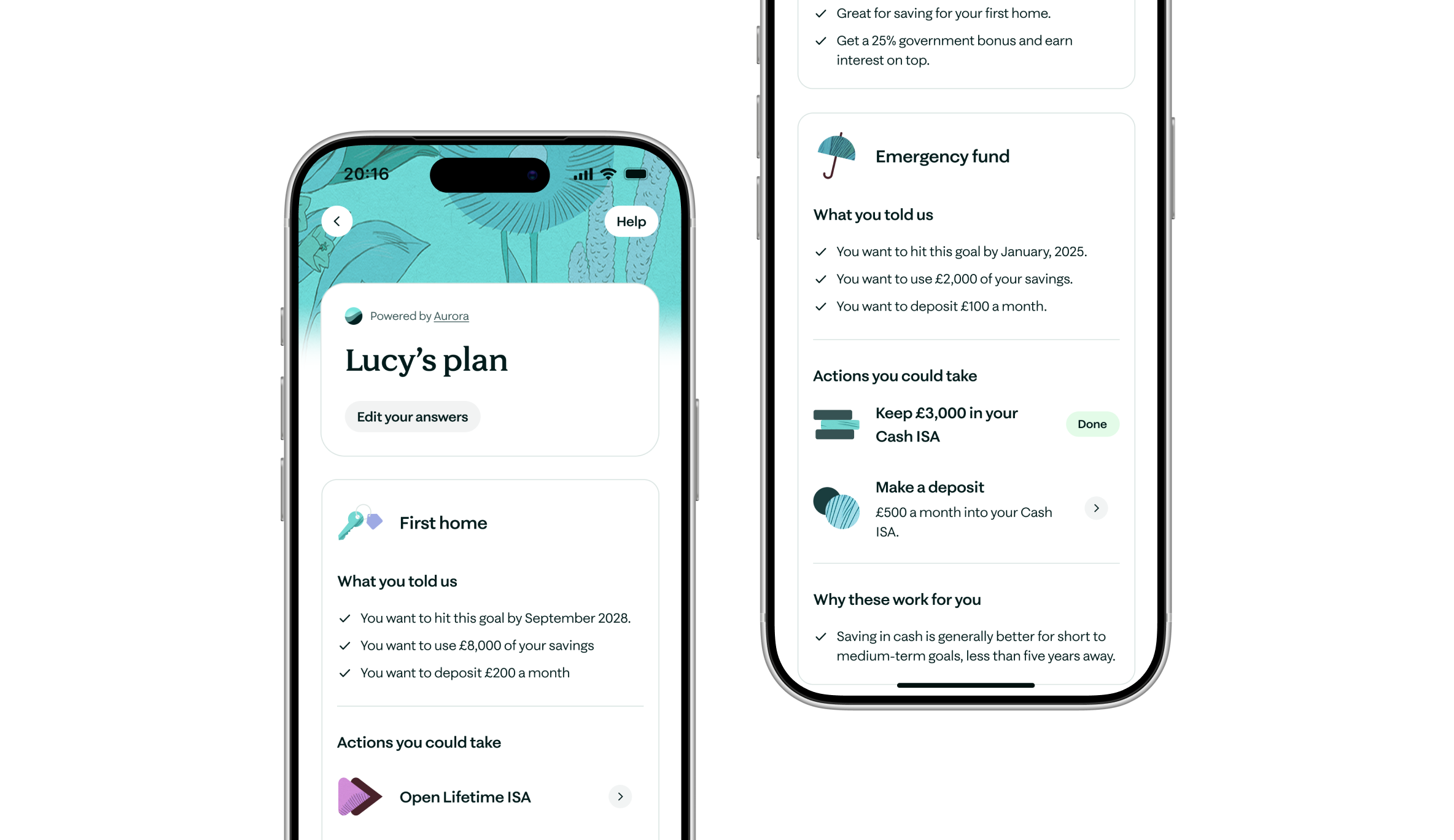

Clear, actionable next steps

Users receive practical recommendations based on their goals, balances and time horizons - from increasing contributions to reallocating savings or exploring products that better support their ambitions.

Get in Touch

This website is just a little peek into my work. I’ve got plenty more I’d love to yap about – if you’d like to hear it more, let’s chat!

Moneybox – 2025

Financial Planning

Context

Many Moneybox users have clear financial ambitions - buying a home, building long-term wealth, or growing savings - but aren’t sure which products to use or how to make meaningful progress. As a result, users often keep money in suboptimal places (e.g., large cash balances that could be invested), or hold only one or two products despite having broader goals.

To support users with clearer direction and help them get more out of Moneybox, we set out to design a confidence-building experience that captures a user’s ambitions and turns them into simple, personalised next steps.

This work ran for five months across design, research, and build, with close collaboration between Product, Engineering, Data Science/Decisioning, Marketing, Compliance, and Insights.

Problem

Users frequently struggled to choose the right Moneybox products for their goals. This hesitation was visible in behaviour - especially the long time spent on the “Select an account” screen during registration and cross-sell flows. It was a clear sign that users lacked confidence in understanding which product aligned with their needs, timelines, and risk levels.

This uncertainty led to low product adoption, money sitting in less effective accounts, and weaker retention - particularly among higher-value customers who often moved money between providers. We believed that if users could articulate their ambitions and receive clear, personalised next steps, they would make more confident decisions and engage more deeply with Moneybox’s product ecosystem.

Outcome

A guided flow for capturing ambitions

We designed a structured journey that helps users articulate both their near-term needs and long-term goals. This forms the basis of their personalised plan while staying fully within FCA guidance boundaries.

Personalised guidance at every step

Throughout the flow, users see small, tailored nudges that offer guidance based on their situation. These moments help them move through the journey with confidence and make each decision feel more personal.

A simple way to organise money across goals

We introduced an allocation step that helps users divide their savings across the goals that matter most to them, giving them a clearer sense of how they can optimise their money.

Clear, actionable next steps

Users receive practical recommendations based on their goals, balances and time horizons - from increasing contributions to reallocating savings or exploring products that better support their ambitions.

Get in Touch

This website is just a little peek into my work. I’ve got plenty more I’d love to yap about – if you’d like to hear it more, let’s chat!

Moneybox – 2025

Financial Planning

Context

Many Moneybox users have clear financial ambitions - buying a home, building long-term wealth, or growing savings - but aren’t sure which products to use or how to make meaningful progress. As a result, users often keep money in suboptimal places (e.g., large cash balances that could be invested), or hold only one or two products despite having broader goals.

To support users with clearer direction and help them get more out of Moneybox, we set out to design a confidence-building experience that captures a user’s ambitions and turns them into simple, personalised next steps.

This work ran for five months across design, research, and build, with close collaboration between Product, Engineering, Data Science/Decisioning, Marketing, Compliance, and Insights.

Problem

Users frequently struggled to choose the right Moneybox products for their goals. This hesitation was visible in behaviour - especially the long time spent on the “Select an account” screen during registration and cross-sell flows. It was a clear sign that users lacked confidence in understanding which product aligned with their needs, timelines, and risk levels.

This uncertainty led to low product adoption, money sitting in less effective accounts, and weaker retention - particularly among higher-value customers who often moved money between providers. We believed that if users could articulate their ambitions and receive clear, personalised next steps, they would make more confident decisions and engage more deeply with Moneybox’s product ecosystem.

Outcome

A guided flow for capturing ambitions

We designed a structured journey that helps users articulate both their near-term needs and long-term goals. This forms the basis of their personalised plan while staying fully within FCA guidance boundaries.

Personalised guidance at every step

Throughout the flow, users see small, tailored nudges that offer guidance based on their situation. These moments help them move through the journey with confidence and make each decision feel more personal.

A simple way to organise money across goals

We introduced an allocation step that helps users divide their savings across the goals that matter most to them, giving them a clearer sense of how they can optimise their money.

Clear, actionable next steps

Users receive practical recommendations based on their goals, balances and time horizons - from increasing contributions to reallocating savings or exploring products that better support their ambitions.

Get in Touch

This website is just a little peek into my work. I’ve got plenty more I’d love to yap about – if you’d like to hear it more, let’s chat!